Money received in any way by a business is a receipt. Before one can be recorded, at least one cash account or bank account must be established.

Basic receipts

Once at least one cash or bank account exists, receipts are recorded in the Receipts tab by clicking on New:

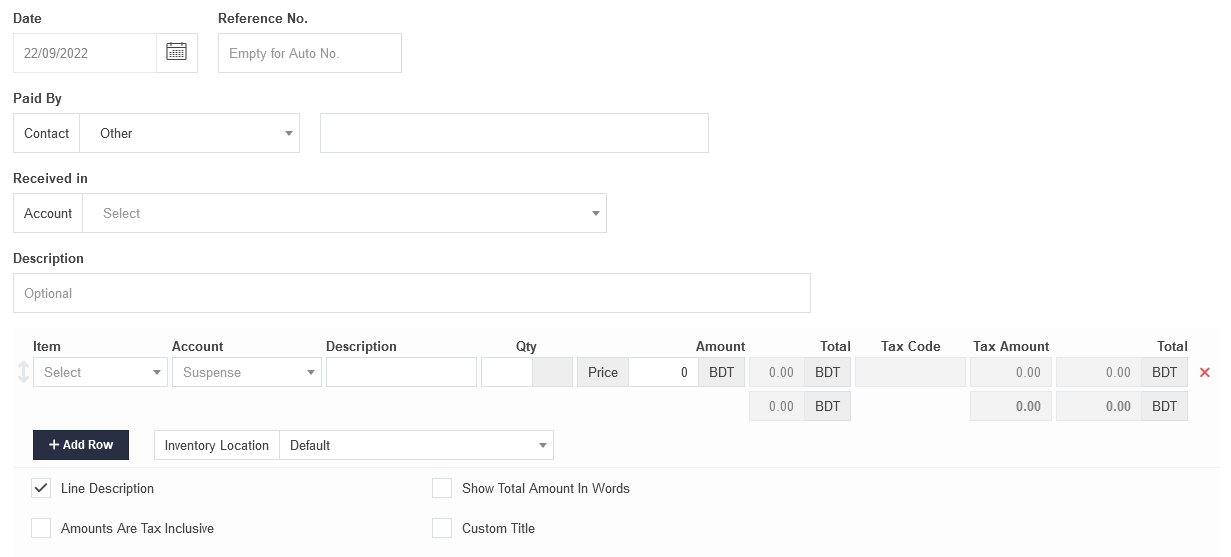

Complete the entry. Screen layout varies depending on which options are checked:

- Date is automatically filled with today’s date, but can be edited.

- Reference Accountly will number the transaction automatically, if the field is empty. The program will search for the highest number among all existing receipts and add 1. It may be used for cheque numbers, bank confirmation numbers, or other internal sequences.

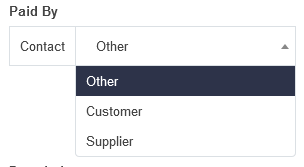

- Paid by is the person or entity from whom money is being received. Other allows free text entries. But Customer or Supplier can also be selected, in which case the Paid by field becomes a dropdown list of predefined customers or suppliers, as appropriate:

Note

If a customer or supplier is chosen, the address for that customer or supplier will be displayed on the completed receipt form. It will not, however, show on the entry screen. - Received in is where you select the bank or cash account into which the money is being received.

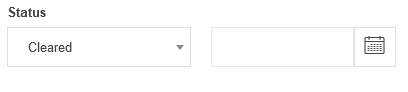

- If a bank account is selected, a Status field appears, in which Cleared or Pending can be chosen. Status is set to Cleared by default for bank transactions. For transactions not cleared the same date, the clearance date may be entered:

Another Guide Article covers cleared and pending transactions in greater detail. These fields are absent for cash account transactions. - Description is an optional summary of the overall transaction.

- Item field can be used to enter predefined inventory or non-inventory items. If you have no predefined items, this field will not appear. Making a selection here will prefill several other fields on the line.

- Account is the account to which the receipt will be posted.

- Description on individual line items allows more specific information to be added. This field is displayed only if the Line Description checkbox below the line item(s) is checked.

- Qty is where you enter the quantity of goods or services for the line item. If left blank, the program interprets the quantity as 1.

- Amount lists the price of a single unit or, the entire amount for the line item.

- A Tax Code can be selected if any have been defined and if the Account field contains an account to which tax codes can be applied.

- An Inventory location Default is selected by default. You can re-name it or add more inventory items:

- A Custom title can be entered to match local usage. Enter the title in the text field that appears if the box is checked.

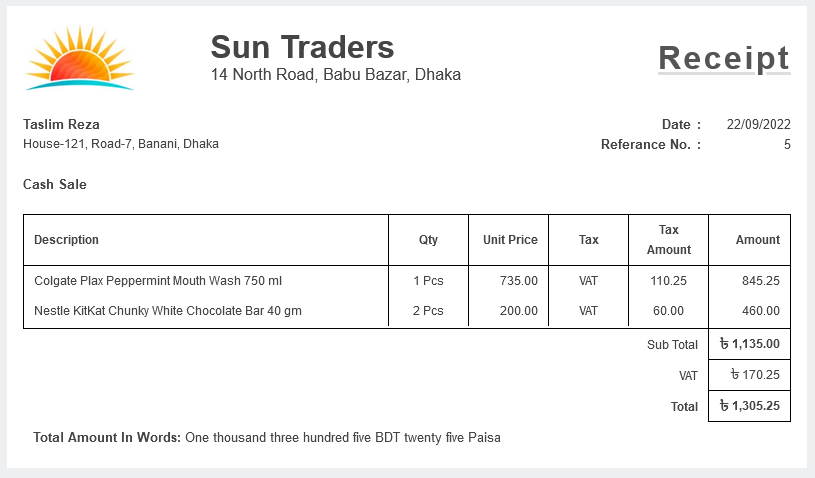

Click Create to save the receipt. The completed form can be given to the payer to document the transaction:

Receipts against sales invoices

Receipts from customers against sales invoices can be entered two ways:

- As a basic receipt

- From a sales invoice

As a basic receipt

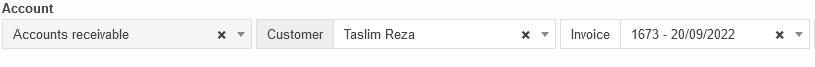

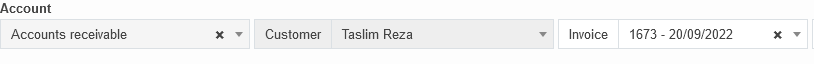

To enter a receipt against a specific invoice, post it to Accounts receivable, the Customer, and the Invoice:

Note

If a customer has been chosen in the Paid by field, that customer will be automatically entered:

Partial receipts

When receiving money for only part of the balance due on a sales invoice, post the transaction as above, but enter only the amount actually received. Accountly will credit the partial amount against the sales invoice and show a reduced balance due. No other special steps are necessary.

Receipts for multiple sales invoices

When receiving money from a customer for multiple sales invoices, leave the Invoice dropdown field blank. Accountly will allocate the receipt against the sales invoice with a balance due with the oldest due date first, then the next oldest, etc. However, if the receipt is designated for specific sales invoices, add lines and designate amounts for those invoices individually.

From a sales invoice

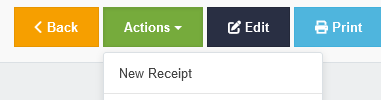

To record a receipt while viewing a sales invoice, click on New Receipt from Actions group:

A receipt entry form will appear. Select a bank or cash account. The remainder of the form will be prefilled with information to enter the full amount due on the sales invoice. If the receipt is for only part of the balance due, edit the amount received by adjusting the unit price.

Other situations

You are not restricted to using only simple income accounts or Accounts receivable to post receipts. For example, if money is received from a business owner set up under the Capital Accounts tab, select the matching capital account and subaccount:

Inventory and non-inventory items can also be directly sold using receipts. For more information on selling without sales invoices see this Guide Article.