Bank accounts are sources or repositories of money maintained by a financial institution of any type. Virtually every business needs at least one bank account. Possibilities include:

- Bank accounts

- Credit cards

- PayPal accounts

- Crypto-currency accounts (e. g., BitCoin)

Cash accounts are used to record current transactions involving bills and coins. They are maintained by a business as physical repositories of cash. Possibilities include:

- Petty cash funds

- Cash tills

Create an account

Click the Bank and Cash Accounts, then New Bank Account or New Cash Account:

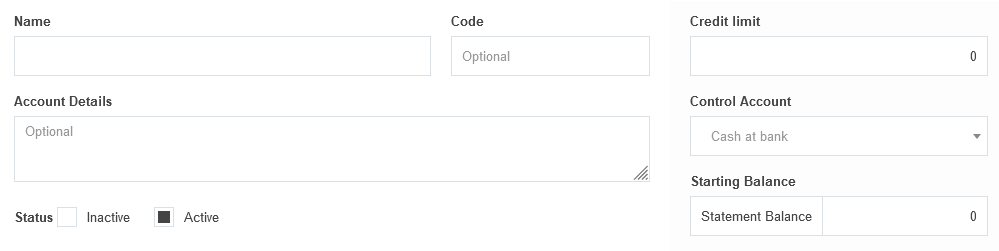

Define the account:

- Name the account so it will be recognizable. The name could include a description, a bank’s name, a credit card designation, or an account number.

- Code allows you to set the order in which accounts are listed. Enter an integer number. If blank, accounts will display in alphabetical order.

- Control account options are available if a custom control account comprising bank and cash accounts has been defined. The default control account for new bank accounts is Cash at bank, and for new cash account is Cash at hand.

- If migrating to Accountly from an earlier accounting system, enter a Starting balance .

- Credit limit can be set, especially for credit cards. You can also use this field to indicate the amount of overdraft protection.

- Status Inactive can be checked if the account is closed. (Accounts cannot be deleted from Accountly if they have any past transactions, because doing so would eliminate the records of those transactions and affect active Balance Sheet accounts.) If Inactive is checked, the account will not appear in lists for transactions in the Receipts or Payments tabs. The account will be greyed out in the Bank and Cash Accounts tab listing. Checked Active, to restore to active status.

Notes

You should only add accounts that belong to the business. Personal credit cards and personal bank accounts used infrequently for business transactions should not be added as bank accounts.

The same form is used for entering cash accounts as for bank accounts.

View account balances

By default, all accounts are combined into an automatic control account named Cash at bank or Cash at hand for Balance Sheet reporting.

Example

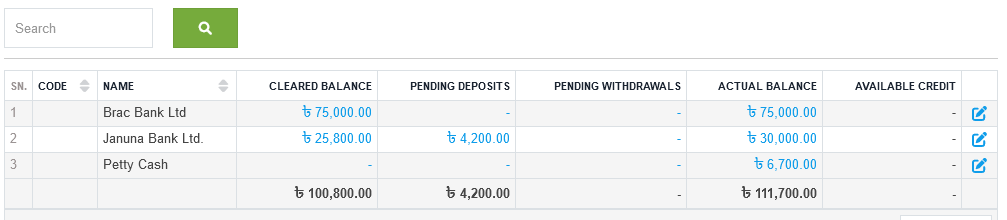

Sun traders has tow bank accounts for its business activities and a cash account named Petty cash. The Bank and cash accounts page shows the sum of all account balances with actual, not cleared, balances:

Note

In the Bank and Cash Accounts tab, you can find information about all accounts, even if you have modified your chart of accounts so they are reported on the Balance Sheet under different control accounts.