A chart of accounts is an organized list of all accounts in a business entity’s financial records. An account is where a financial transaction is classified, allocated, or posted. (These terms all mean the same thing.)

Every account has a balance based on additions and subtractions made since it was opened (or during a specified period of time). So summaries or totals of balances of various types or groups of accounts are often included when displaying a chart of accounts. But strictly speaking, only the accounts themselves make up the chart of accounts.

The chart of accounts will:

- Govern how every single transaction a business makes is recorded

- Determine what information management views to make important decisions

- Support government regulatory and tax filings

- Organize information for presentation to bankers, owners, creditors, and auditors

So it should be thought out carefully. Once it has been developed, written descriptions of which types of transactions are posted to each account are convenient reminders and can be helpful during audits, when working with accountants, and for training new users or reminding established ones.

Although the effort of building a good chart of accounts produces no direct revenue, it costs little or nothing, but will improve operations far into the future. A well-designed chart of accounts ultimately makes your business easier to manage and can save time and money. Understanding some basics will help you develop a good one.

Types of accounts

Accounts have been classified the same way by accountants and bookkeepers everywhere for over 500 years. (Nobody said accounting was exciting.) Classification depends on whether accounts depict your current financial position or determine your performance over a period of time. They are named for the two most important financial statements of any company: the balance sheet and the profit and loss (P & L) statement, also called the income statement.

Accounts depicting position are called balance sheet accounts, because they appear on the balance sheet. (See, this is easy!) They are also sometimes referred to as permanent or perpetual accounts, because they carry forward from one accounting period to another. When up to date, they define the state of a business at the current moment.

Balance sheet accounts

- Asset accounts represent the value of what you own, including cash, inventory, fixed assets, and other things.

- Liability accounts represent what you owe to others outside the business, including loans, employee wages earned but not yet paid, and so forth.

- Equity accounts record how much money is invested in the business, including profits that have not been distributed. Equity can be thought of as the net worth of a business. (Net worth is different from value, which is what someone might pay to buy the business.)

Accounts determining performance are called profit and loss or income statement accounts, because they appear on reports of the same name. (You probably predicted that.) Balances for these accounts are calculated over a specified timeframe or accounting period, such as a month, quarter, or year.

Profit and loss accounts

- Income (or revenue) accounts record amounts earned by the business

- Expense accounts record amounts spent on business activities (not including any withdrawals, dividends, or distributions to owners or shareholders)

Businesses may subdivide their accounts into elaborate hierarchies. But all accounts are one of those five basic types. There are no exceptions. (That would be too exciting.)

Accounting equations

Accounting begins with the simple equation:

Assets – Liabilities = Equity

This is just an accountant’s way of saying the difference between what a business owns and what it owes is its net worth. (You already knew that, right? This is getting simpler.)

To make things seem mysterious so they can keep their jobs, accountants like to scramble that equation a little by moving Liabilities to the right side of the equation (reversing the sign, of course):

Assets = Liabilities + Equity

This version of the equation says the sum of all asset account balances must equal the sum of all liability and equity account balances. Details of this balance constitute your financial position at any given time. A proper chart of accounts and good accounting procedures make sure the two sides of the accounting equation are always equal. That’s what shows on a balance sheet, nothing more, though specific accounts in each type and their arrangement may vary.

Example

Arif has a bank account balance of 10,000 to start his messenger service. That is an asset. But 8,000 of that amount was obtained as a loan, a liability. Arif’s equity, or net worth, is 2,000. In fact, that is the amount he had saved and put into the business venture. His accounting equation is:

10,000 (Assets) = 8,000 (Liabilities) + 2,000 (Equity)

But how can a business grow (or fail, for that matter)? This is where those profit and loss accounts fit into the picture. Revenue earned by a business adds to Assets, possibly by increasing a bank account. Or it might take the form of a receivable, that is, an amount earned and invoiced to a customer but for which money has not yet been received from the customer. A receivable is still an asset, because it has value to your business.

In contrast, expenditures by the business effectively decrease assets, reducing that bank account or creating a payable, or amount owed to a supplier. The accounting equation can be extended:

Assets = Liabilities + Equity + Income – Expenses

Elements of this equation can be grouped without changing its meaning:

Assets = Liabilities + Equity + (Income – Expenses)

The portion in parentheses is called net profit and is what shows on the profit and loss statement and defines your performance. So the extended equation combines position and performance into one calculation, merging status at a moment with changes not yet transferred into the permanent accounts.

If you spend less than you make, you are profitable. Profits can increase your Assets. Or they can reduce your Liabilities. Either increases Equity. The creative aspect of business involves using Assets, Liabilities, and Equity to generate profits. Eventually, profits are converted to Equity and can be moved out of the business and into owners’ pockets. The chart of accounts guides and records that process. (And you thought accounting would be completely boring. Well, it mostly is, until you get to the last step about putting money in your pocket.)

Debits and credits

The extended accounting equation can be ungrouped and rearranged one more time:

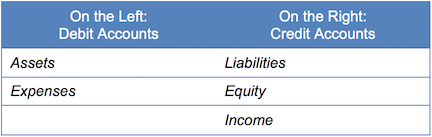

Assets + Expenses = Liabilities + Equity + Income

Why bother? Because this version can help you understand the deepest mystical secrets of accounting: debits and credits. Scholars, Latin linguists, and historians disagree about origins of those terms, including who first used them, when, and in what language. Every story is thorough and convincing. But you don’t need to know any of them.

You only need to know two things about debits and credits:

- Your natural understanding of them from dealing with banks, merchants, and others who send you bills is probably backwards. The terms they use are not from your perspective, but from your bank’s or the merchant’s. All accounting is done from the perspective of the one keeping the books. So your bank’s debit is your credit.

- For accounting purposes, debit means “on the left” and credit means “on the right.”

Looking at the rearranged equation just above, Asset and Expense accounts are debit accounts. They are on the left side of the equal sign. Liability, Equity, and Income accounts are credit accounts. They are on the right. (Pretty simple, eh?)

A debit transaction increases a debit account. A credit transaction increases a credit account. The reverse is also true. Debit transactions decrease credit accounts and credit transactions decrease debit accounts. So (here comes the magic), you can determine whether a transaction is a debit or credit by whether it increases an account on the left (a debit) or the right (a credit). (Yes, you can do it the other way round, too, but that’s harder to remember.)

This relationship between debits and credits and the need to keep both sides of the accounting equation in balance led more than five centuries ago to invention of double-entry accounting. Every transaction starts out as a debit or credit posted to one of the accounts in your chart of accounts. But to balance your books, it must be offset by an opposite credit or debit to a different account.

Example

Arif begins operating his messenger service. During the first month, he spends 2,500 from his bank account to pay operating costs. The transactions increase various Expense accounts on the left side of the equation. So the Expense accounts are debited. They also decrease his bank account, an Asset account, also on the left side. So the bank account is credited the same amount. (Yes, a payment from a bank account is a credit, showing that what you probably thought you knew was wrong.)

At the end of the month, Arif deposits 4,000 received from customers into the bank. This transaction increases an Asset account, on the left side, so the bank account is debited. To balance this, an Income account, on the right side, is credited with 4,000. After these changes, Arif’s bank balance is 11,500, and his extended accounting equation is:

11,500 (Assets) + 2,500 (Expenses) = 8,000 (Liabilities) + 2,000 (Equity) +4,000 (Income)

Everything is still in balance. Arif’s new business is profitable and growing.

Fortunately, when using Accountly, you don’t have to remember most of this. Except for occasional journal entries, all transaction forms in Accountly determine which accounts to debit and credit based on context. When faced with a decision, refer back to this Guide. And remember the rule that debits increase debit accounts and credits increase credit accounts.

Design considerations

Designing your chart of accounts is one of the most important things you do when starting a business or adopting Accountly. Poor design will irritate you every day. Yet too many businesses undertake the task in a hurry. Do some research first. Check with local authorities. Consult an accountant or attorney (or both) to prevent costly problems. Several factors should influence your design:

- Laws and regulations. You may need accounts to record taxes collected or paid. If you have employees, you need accounts for wages, contributions to retirement funds, etc.

- Business type. Retail shops need different accounts than repair businesses, consultants different than manufacturers, and schools different than social clubs.

- Size. Larger companies with several divisions or locations need more complex charts of accounts than smaller ones.

- Legal organization. Partnerships need capital accounts; sole traders or proprietors may not. Trusts and corporations have different needs, too.

- Government filings. All charts of accounts should be set up to easily support filings you will make, especially tax returns. It is much easier to post transactions to accounts that match forms than to laboriously back them out of a jumble when a filing deadline approaches.

- Management needs. Accounts should support management decisions during the current accounting period. They should also support comparison with previous periods. But it is pointless to collect information you cannot use.

- Permanence. Remember that once an account has been used, Accountly will not let you delete it. So good practice includes accounts useful over the long term. Creating accounts for one-time events is usually poor practice. For example, accounts collecting transactions on a category of customers are better choices than accounts set up for individual customers who might never buy again. Accounts to handle expenses for events are fine, but accounts for the 2017 charity fundraiser might not be a good idea. They will clutter your financial statements in 2022.

Notes

Smart planning will involve adding a test business in Accountly. You can experiment with typical transactions you expect to use in your business to evaluate how your chart of accounts supports your needs. Investigate whether available reports will provide information you want. You will be much happier deleting a few sample transactions or starting over with a new test business than rebuilding your real accounting records if things don’t work out.

Detailed instructions for building a chart of accounts are found in Build a chart of accounts.