Customer deposits and advances are funds received by a business from a customer before they have been earned. While the funds may be present in a bank or cash account of the business, they are actually being held in trust for the customer and represent a liability the business must eventually either repay or convert to income by completion of the economic activity for which they are intended. Some examples include:

- Deposits accompanying purchase orders for custom manufacturing

- Receipts from prepayments for services or utilities to be invoiced later to the customer

- Deposits received for confirmation of hotel reservations

- Cleaning or damage deposits for rental property received from tenants

Accounting for deposits and advances

Two essential facts must be recorded for every deposit or advance:

- Customer - who is making the deposit?

- Amount - how much is the deposit?

In Accountly, both facts are recorded simultaneously when the deposit or advance is received. To receive a deposit, go to the Receipts tab and click New:

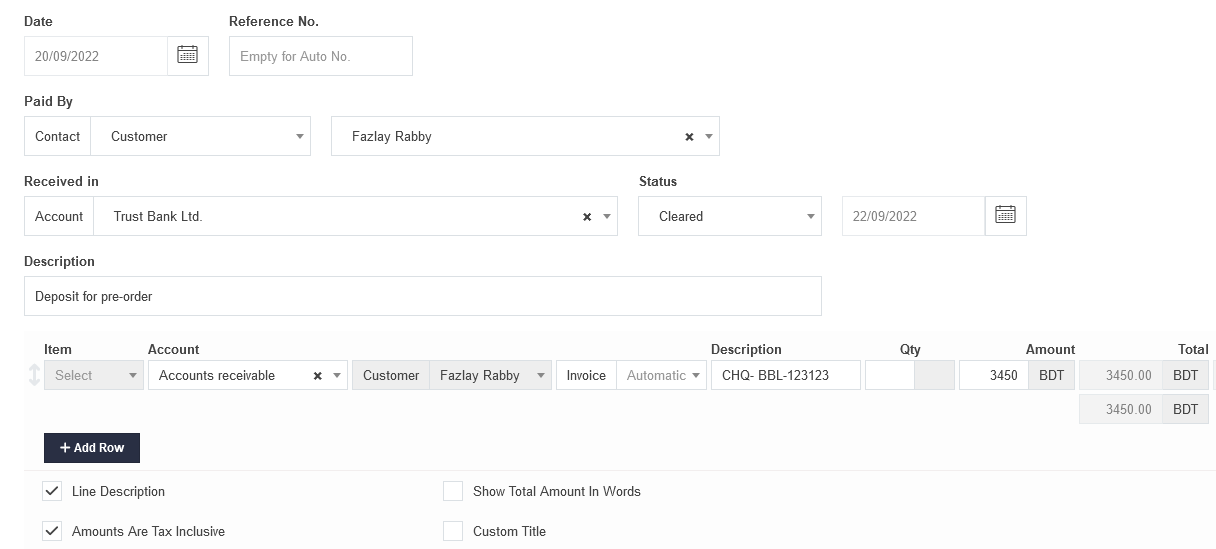

Complete the receipt form as you would for any other receipt:

- Under Paid by, select Contact type as Customer. Choose the customer from the dropdown menu. (The customer making the deposit must already by defined.)

- Do not select anything in the Item field, even if the deposit is for an inventory or non-inventory item.

- Under Account, select Accounts receivable. The customer’s subaccount will automatically be selected to match the customer designated under Paid by. This choice cannot be edited. (See note below.)

Note

If the deposit is paid by someone other than the customer for whom the deposit is intended, the Contact type above must be Other. Then, you will be able to choose any customer’s subaccount under Accounts receivable. - Leave the Invoice field blank.

- A quantity is not required in the Qty field, because no inventory items or billable items are involved with a deposit. You may simply enter the total deposit in the Amount field. However, if you wish, enter the quantity and unit price and Accountly will calculate a total.

- Tax code is normally left blank, because deposits or advances are not usually taxable events. However, rules in your jurisdiction may differ, especially if the deposit is for specific goods or services that will be delivered later. Check with a local accountant or your tax authority to be sure.

Using deposits and advances

The receipt will now be added to the applicable bank or cash account’s balance:

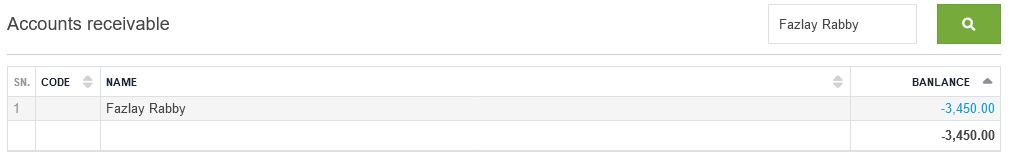

The deposit also reduces the total Accounts receivable balance, though the effect of a specific deposit will probably be obscured on the Balance Sheet by receivables and deposits from other customers. To view specific information about customer deposits, you can drill down by clicking the Accounts receivable balance on the Summary page and locating the customer’s account Balance:

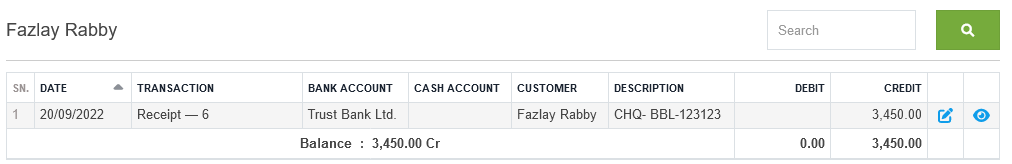

Clicking on the balance, you can see transactions contributing to it, including the recent deposit:

You can do the same thing in the Customers tab, with similar results.

Whenever a sales invoice is created for a customer, any available net credit in that customer’s Accounts receivable balance will be automatically applied, reducing the balance due on the new sales invoice.

Note

Deposits and advances cannot be applied on sales recorded only via cash receipts. Such transactions are not processed through Accounts receivable, so Accountly cannot apply any available balance. If you sell to a customer on a cash-and-carry basis, but wish to apply an existing deposit or advance, you must create a sales invoice and receive money against it in separate transactions.