Each capital account you create automatically has the following subaccounts:

- Drawings

- Funds contributed

- Share of profit

Subaccounts are useful for segregating movements to and from capital accounts. Default subaccounts are sufficient for most businesses, but you can add, remove or rename subaccounts under the Accounts menu by selecting Capital subaccounts:

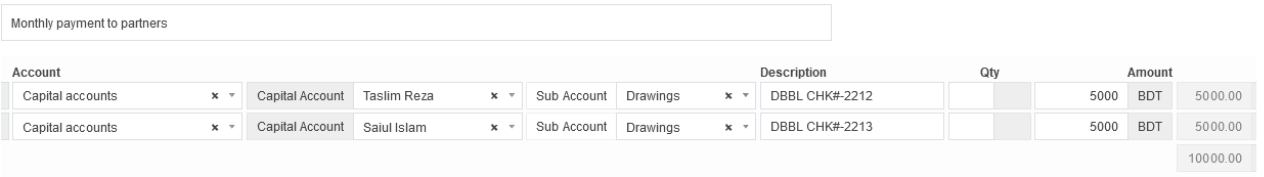

Drawings

Drawings tracks money a partner, beneficiary, or member withdraws from the business. When you transfer funds from a bank account to a member, or if the business pays a private expense on behalf of a member, the transaction should be posted to the Drawings subaccount:

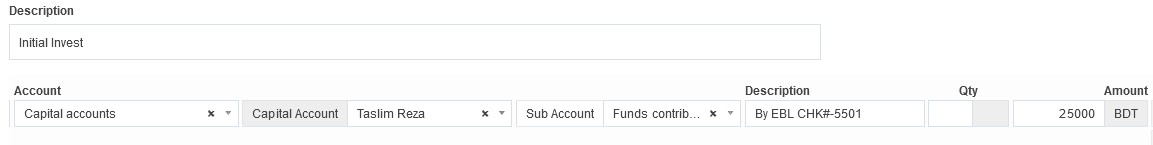

Funds contributed

Funds contributed tracks money a member has contributed to the business. When a member deposits personal funds into a business account, the transaction should be posted to the Funds contributed subaccount:

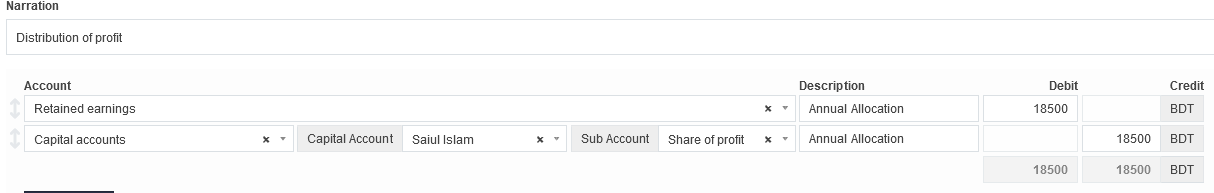

Share of profit

Share of profit is used to allocate net profit from Retained earnings to Capital accounts. Only certain types of legal entities are required to distribute profit to owners. Such distributions are often done by an accountant at the end of a financial period using journal entries:

They prevent earnings from accumulating endlessly in Retained earnings. Such distributions show that funds are no longer available for general business operations, but have been earmarked for the capital account owner.