Capital accounts track contributions from, distributions of earnings to, and drawings of owners or others with financial interests in a business entity. They can be adapted to suit any type of entity, including sole proprietors, partnerships, companies, trusts, and funds.

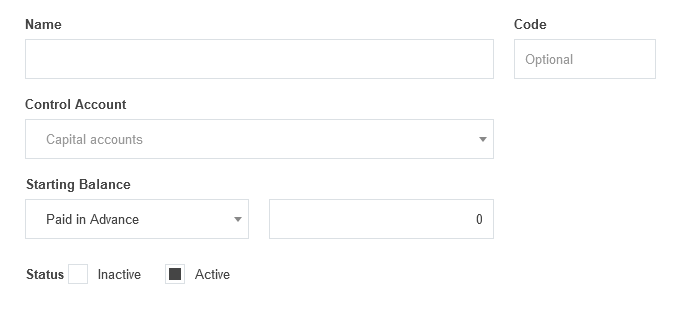

In the Capital Accounts tab, click New to define a member or owner of a capital account:

- Name is the owner of the capital account.

- Code is optional and can be any alphanumeric entry.

- Control Account leave it empty to use default.

- Starting balance fields appear if a start date has been set, allowing capital account balances to be migrated from prior accounting systems. The dropdown menu allows a choice of whether the capital account owner has Paid in advance (a credit balance) or there is an an Amount to pay by the business (a debit balance).

Click Create to save.

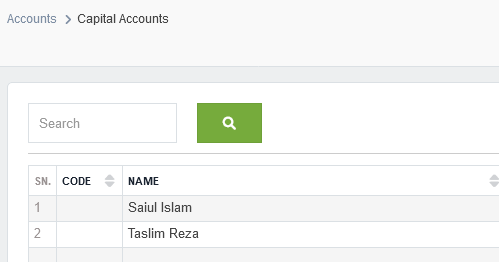

Sole proprietorships require only a single capital account. Partnerships require a capital account for each partner. Trusts require one for each beneficiary. Funds require a capital account for each member. Repeat the process described until all capital accounts have been established:

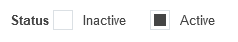

If capital account members leave the company, they cannot simply be deleted, because there are transactions that reference them. Instead, make them inactive by editing them and checking the Inactive box:

Inactive members appear in gray at the Capital Accounts list. They can be reactivated again any time.

By default, all capital accounts are combined as Capital accounts in the Equity section of the Balance Sheet:

Sometimes, it is necessary to rename the account. For example, if the business operates as a sole proprietorship, the account can be renamed as Owner’s equity. Click edit under Chart of Accounts. The new name will show, but the default name will be visible in the Settings tab:

Note

In some situations, sole proprietors need not add the complexity of capital accounts to their business records. See Simplify equity accounting for sole traders / proprietors for a discussion of a simpler approach to equity accounting.

Sole proprietors and partnerships are unincorporated, meaning they have no shareholders. Their capital accounts can be set up as described in this Guide. But companies or corporations (terminology varies in different jurisdictions), trusts, and funds are separate legal entities. Depending on the legal structure of a business, it may be nessessary to change the classification of Capital accounts from Equity to Assets if they have debit balances or Liabilities if they have credit balances. When in doubt, consult with a local accountant to be sure.